Gas Prices Continue to Fall

The price of oil continues to drop and Goldman Sachs is now placing their oil futures for 2015 at a sickly $42 per barrel. This is great news for consumers, obviously, but could spell the end for many fracking operations and other shale projects. This news comes at the heels of already major blows to the industry, with the Keystone XL pipeline bill looking dead on arrival and the recent ban on fracking for the entire New York state.

It is no secret that fracking is a very unproductive industry and the price per barrel of oil needs to be at least $60 to provide any gains.

With the price expected to stay in its freefall state, all the smaller drilling companies are expected to go belly-up this year, with WBH Energy LP already leading the way in its recent announcement to file bankruptcy on a debt accumulated of up to $50 million dollars.

Riding the Bull

OPEC has decided to keep oil production steady and believes that it is up to the market to fix itself. Sounds a bit insane, but the oil and gas industry is not a pretty business to begin with, playing nice is not part of the rulebook.

Concern from oil’s biggest producers, Venezuela and Saudi Arabia, is merely for show, as we have already heard from the Saudi prince billionaire Al-Waleed bin Talal that he wants to keep the price per barrel low because, as he has said to USA Today:

“If some supply is taken off the market, and there’s some growth in demand, prices may go up. But I’m sure we’re never going to see $100 anymore. I said a year ago, the price of oil above $100 is artificial. It’s not correct,”

Needless to say, investors all over the globe are putting their money elsewhere for 2015. Alternative energy is the future and only those who are the very top of the totem pole will weather the storm that is coming. To-date, oil prices have fallen by 50% in the past decade, use this as an opportunity to reinvest your money into more future-proof commodities.

Listening to Nigeria’s Cries For Help

Twistity Sports Exclusive: MAHALO, MARCUS MARIOTA

-

In a significant legal development, U.S. District Judge Aileen Cannon has declined former President Donald Trump’s request to dismiss...

-

Major Collision Causing the Collapse of the Bridge The recent collapse of the Francis Scott Key Bridge in Baltimore,...

-

Donald Trump is on the brink of a crucial deadline in a business fraud case, with just a few...

-

Sylvia Gonzalez, a newly elected city council member in a small Texas community, was embroiled in controversy when she...

-

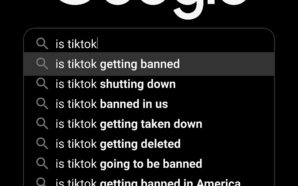

Is TikTok Getting Banned in the States? The United States House of Representatives has voted with bipartisan support to...

-

Ken Griffin, the founder and CEO of Citadel, emphasized the importance of prudence in the Federal Reserve’s strategy regarding...

-

The 2024 Election Race Continues Between Joe Biden and Donald Trump With the 2024 general election drawing closer, President...

-

Michael Saylor, a prominent figure in the world of cryptocurrency, has seen significant gains this week as the value...

-

Another Successful Moon Landing Intuitive Machines, a commercial space company, has achieved a remarkable feat by landing its Odysseus...

-

The Office for National Statistics (ONS) released official figures on Wednesday, revealing that the United Kingdom posted a record...

-

Has the State of USA Improved Since Trump’s Presidency or Gotten Worse? Given the current climate of the United...

-

In a surprise speech delivered from the White House, President Joe Biden addressed the recent special counsel’s report and...