Early on the morning of Thursday October 17, President Barack Obama signed into law a bill that raises the debt ceiling and extends government financing until January 15, granting another few months for a debt solution to be reached. This bill comes following a sixteen day long government shutdown. The bill moves the date of debt default to February 7, 2014.

Renewed Hope in Asia

With the news of default postponement also comes new of growth from Asian markets. Stocks from across Japan have seen raises across the board. Honda Motor grew 1.2 percent, Nikon nearly raised a full 1 percent, and both the Topix index and the Nikkei average both rose 0.8 percent. This marks the highest point in many months for many of these companies. Japan also saw increases in exports, with companies benefiting from a weaker yen. The success story of Japan, however, is Kansai Electric Power which leapt nearly 3 percent.

Stocks in China have slipped, with the Shanghai Composite lowering a little more than 0.2 percent, but China continues to see increased investment from foreign accounts. The People’s Bank of China has released a statement declaring that it will maintain the liquidity of its funds through improved and “prudent” practices.

To the South

Australian stocks all saw moderate rises, with companies in the fields of healthcare and banking seeing the greatest gains. Westpac, NAB, and ANZ all saw rises around 1 percent while Boral stock rocketed skyward, growing approximately 6 percent. This rise comes following news that the company and US-based USG Corp have formed a joint venture to create USG Boral Building Products. In Australia, business and consumer confidence has hit an all time high following the new election.

South Korean stocks saw increases as well, as foreign investors continue to feverously buy up local stocks. The 282.9 billion worth of purchased stocks brings the Kospi up to 2040. Considering all the companies that saw growth, shipbuilding companies were among those that saw greatest growth with Daewoo Shipbuilding, Hyundai Heavy Industries, and Samsung Heavy Industries all rising more than 3 percent.

New Zealand’s own NZX-50 saw a 0.4 percent rise while Diligent Board Member Services, Hallenstein Glasson Holdings, and Air New Zealand all saw growth between 1 and 3 percent. Surveys by ANZ and Roy Morgan show that consumer interest has been rising steadily in this country, with the consumer confidence index soaring to 122.3 and expected to rise.

These trends continue throughout the southern Pacific with Taiwan and Malaysia rising between 0.3 and 0.5 percent.

India’s Sensex declined 0.4 percent but is expected to level out.

Back at Home

In response to both new legislation and foreign market growth, U.S. stocks have also see improved growth. Dow and the S&P 500 grew around 1.4 percent. The Nasdaq grew 1.2 percent, soaring to a new thirteen year high. Consumer confidence grows, and business is expected to continue seeing such resounding success if the momentum can be kept up.

-

Bank of America has reported impressive first-quarter earnings, surpassing analysts’ estimates for both profit and revenue, driven by better-than-expected...

-

Plans for Neom’s ambitious “The Line,” a zero-carbon city in Saudi Arabia, have been revised, scaling back its initial...

-

President Joe Biden’s reelection strategy takes a surprising turn as the Rust Belt, not the Sun Belt, emerges as...

-

In a significant escalation of the ongoing dispute over misinformation, Brazil Supreme Court Justice Alexandre de Moraes has initiated...

-

In a significant legal development, U.S. District Judge Aileen Cannon has declined former President Donald Trump’s request to dismiss...

-

Mumbai Takes the Throne for the Most Billionaires in Asia In a historic milestone, Mumbai has overtaken Beijing to...

-

Major Collision Causing the Collapse of the Bridge The recent collapse of the Francis Scott Key Bridge in Baltimore,...

-

Donald Trump is on the brink of a crucial deadline in a business fraud case, with just a few...

-

Sylvia Gonzalez, a newly elected city council member in a small Texas community, was embroiled in controversy when she...

-

French President Emmanuel Macron emphasized the need for Western powers to remain vigilant in the face of the Ukraine...

-

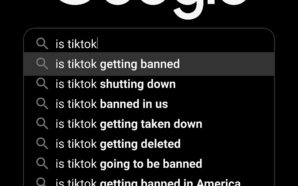

Is TikTok Getting Banned in the States? The United States House of Representatives has voted with bipartisan support to...

-

Ken Griffin, the founder and CEO of Citadel, emphasized the importance of prudence in the Federal Reserve’s strategy regarding...