The Federal Open Market Committee (FOMC) surprised investors and economists yesterday with their announcements that they plan on continuing to buy roughly $85 billion a month in bonds. The FOCM is a committee within the U.S. Federal Reserve that is in charge of the buying and selling powers related to the United States Treasury security. Prior to yesterday’s announcement, rumors circulated that the buying amount would be drastically reduced. This prediction resulted in the Dow Industrial falling 29 points. In a surprising turn of events however, the FOMC kept the buying power the same resulting in very good news for the recovery economy.

Impact of Shutdown

With the economy still trying to recovery from the sixteen day government shut down that occurred at the beginning of the month, the FOMC stated in a prepared press release on Wednesday that they kept the buying limit the same due to what they described as a ‘moderately’ growing economy. The Feds have estimated that the total cost on the economy caused by the shutdown was roughly $25 billion. With employers adding just 148,000 jobs last month, the news that the FOMC has agreed to continue its buying power of bonds at $85 billion a month is superb.

Hoping for Better Housing Market Figures

With the news of putting the tapering on hold, investors also can breathe a sigh of relief with the news that this also means interest rates will remain low. Prior to the shutdown, the economic market was seeing the housing market start to finally pick up. Folks were starting to see the housing market return to a time not seen since 2008 when the housing market first started to collapse. Unfortunately with the recent government shutdown, economic reports were showing a sudden slow down again in the housing market sector. This is one of the considerations the FOMC took into account during its meeting on Wednesday.

What Will the Future Hold?

The next meeting to again discuss tampering will be in December. Economists remained confident than the $85 billion a month figure will still hold true. In Wednesday’s press release, the FOMC stated that there is only a ‘modest’ chance that in December they will reduce their buying. The Chief Investment Officer at Oppenheimer Funds in New York stated to the press that she is confident in the buying remaining the same in the upcoming months. “Until the economic data strengthens, and strengthens meaningfully, I think expectations for tapering (the bond purchases) are going to remain subdued,” she said.

Economists are predicting however that the March meeting of the FOMC could be the one where the buying limit is finally reduced. Chairman Ben Bernanke has announced that after the late January meeting he intends on stepping down. His predecessor has already been announced by the Obama Administration as current Vice Chair Janet Yellen. Her first meeting as Chair will be in March. If the economy has picked up speed like economists hope, many are predicting Yellen will make the move to suggest reducing the buying limit. With ease though that no decision will be made to reduce it if the economy isn’t showing signs of a strong recovery, the economic market yesterday took the announcements as positive news.

The FOMC’s decision to keep the buying limit the same was approved on a 9-1 vote with President of the Kansas City Federal Reserve Bank, Esther George, being the dissenting vote. In wake of the news the dollar rose on the world market bypassing the euro and the yen. While it is still uncertain what next year will hold, the news released Wednesday calmed the fear that the U.S. Government was going to reduce their buying limit. Such a reduction could have resulted in an increase in interest rates to a housing market that is not ready for them. The FOMC’s decision is both positive and a sigh of relief to an economy trying to pull itself out of a recession.

-

Plans for Neom’s ambitious “The Line,” a zero-carbon city in Saudi Arabia, have been revised, scaling back its initial...

-

President Joe Biden’s reelection strategy takes a surprising turn as the Rust Belt, not the Sun Belt, emerges as...

-

In a significant escalation of the ongoing dispute over misinformation, Brazil Supreme Court Justice Alexandre de Moraes has initiated...

-

In a significant legal development, U.S. District Judge Aileen Cannon has declined former President Donald Trump’s request to dismiss...

-

Mumbai Takes the Throne for the Most Billionaires in Asia In a historic milestone, Mumbai has overtaken Beijing to...

-

Major Collision Causing the Collapse of the Bridge The recent collapse of the Francis Scott Key Bridge in Baltimore,...

-

Donald Trump is on the brink of a crucial deadline in a business fraud case, with just a few...

-

Sylvia Gonzalez, a newly elected city council member in a small Texas community, was embroiled in controversy when she...

-

French President Emmanuel Macron emphasized the need for Western powers to remain vigilant in the face of the Ukraine...

-

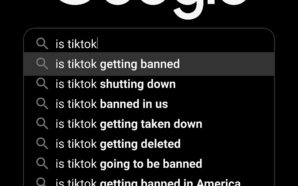

Is TikTok Getting Banned in the States? The United States House of Representatives has voted with bipartisan support to...

-

Ken Griffin, the founder and CEO of Citadel, emphasized the importance of prudence in the Federal Reserve’s strategy regarding...

-

The 2024 Election Race Continues Between Joe Biden and Donald Trump With the 2024 general election drawing closer, President...