Credit: Pexels

Joe Biden Uses Program Fix To Help 800,000 Student-Loan Borrowers

In response to the Supreme Court’s rejection of President Joe Biden’s ambitious student-loan forgiveness plan, his administration has unveiled an alternative form of relief for borrowers. On Friday, the Department of Education announced that it will automatically cancel $39 billion in student debt for 804,000 borrowers, thanks to modifications made to the department’s income-driven repayment plans. These plans were initially designed to forgive student debt after a minimum of 20 years of qualifying payments. However, due to various issues within the system, such as administrative errors and difficulties in tracking payments, many borrowers have found themselves in prolonged repayment periods.

According to a press release, the recent announcement applies to borrowers accrued the equivalent of 20 or 25 years of qualifying months. Under Secretary James Kvaal stated, “At the start of this Administration, millions of borrowers had earned loan forgiveness but never received it. That’s unacceptable. Today we are holding up the bargain we offered borrowers who have completed decades of repayment.”

The forgiveness notices will be sent to borrowers in the coming days and will apply to those with direct student loans or loans under the Federal Family Education Loan program, all of which are held by the Education Department. The forgiveness threshold can be reached during various periods, including any month when the borrower was in repayment status, regardless of whether the payments were partial or late.

BREAKING NEWS: Biden administration forgives $39 billion in student loan debt to more than 800,000 borrowershttps://t.co/ooBBcsnMJX

— Fox News (@FoxNews) July 14, 2023

Additionally, any period of 12 or more consecutive months in forbearance, any cumulative forbearance period of 36 or more months, any pre-2013 deferment month, and any month spent in economic hardship or military deferment on or after January 1, 2013, will count towards forgiveness. The department also noted that months spent before loan consolidation into the federal direct loan program will also be considered for forgiveness.

The Education Department confirmed that loan discharges will commence 30 days after eligible borrowers receive notification emails.

This announcement follows the Supreme Court’s ruling on June 30, which struck down Biden’s plan to cancel up to $20,000 in student debt for federal borrowers. While the court deemed Biden’s approach an overreach of authority, the Department of Education initiated the relief process using the Higher Education Act of 1965. However, this second attempt will take longer due to the negotiated rulemaking process.

-

President Joe Biden’s reelection strategy takes a surprising turn as the Rust Belt, not the Sun Belt, emerges as...

-

In a significant legal development, U.S. District Judge Aileen Cannon has declined former President Donald Trump’s request to dismiss...

-

Major Collision Causing the Collapse of the Bridge The recent collapse of the Francis Scott Key Bridge in Baltimore,...

-

Donald Trump is on the brink of a crucial deadline in a business fraud case, with just a few...

-

Sylvia Gonzalez, a newly elected city council member in a small Texas community, was embroiled in controversy when she...

-

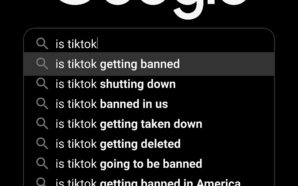

Is TikTok Getting Banned in the States? The United States House of Representatives has voted with bipartisan support to...

-

The 2024 Election Race Continues Between Joe Biden and Donald Trump With the 2024 general election drawing closer, President...

-

The Biden Administration’s Request for a New Texas Immigration Law Blocked The Supreme Court has temporarily blocked the enforcement...

-

Another Successful Moon Landing Intuitive Machines, a commercial space company, has achieved a remarkable feat by landing its Odysseus...

-

Has the State of USA Improved Since Trump’s Presidency or Gotten Worse? Given the current climate of the United...

-

In a surprise speech delivered from the White House, President Joe Biden addressed the recent special counsel’s report and...

-

Is Texas Taking the Right Step Towards a Better America? The Austin Guaranteed Income Pilot, Texas’s pioneering tax-payer-funded basic...