Credit: Unsplash

Climate Shocks and Insurance: The Financial Toll on America’s Homes

The climate crisis is no longer just an environmental concern; it is rapidly turning into a financial crisis. State Farm, California’s largest homeowner insurance company, recently announced that it would no longer offer coverage to homeowners across the state, not just in wildfire-prone areas. This decision reflects a broader trend among insurance companies that either raise rates, limit coverage, or completely withdraw from high-risk areas. The consequences are clear – it is becoming increasingly expensive for people to protect their homes.

The former head of insurance at the Federal Emergency Management Agency, Roy Wright, aptly stated, “Risk has a price.” Insurance companies are finally reckoning with the true cost of climate-related disasters. In parts of Kentucky devastated by storms, flood insurance rates are set to quadruple. Louisiana’s insurance market is in crisis, prompting officials to offer substantial subsidies to attract insurers. Even in Florida, where hurricanes are a constant threat, homeowners are struggling to find affordable storm coverage as major insurers exit the market.

State Farm’s decision to halt new insurance policies in California is driven by the “rapidly growing catastrophe exposure” the state faces. While the company acknowledges California’s efforts to reduce wildfire losses, it prioritizes its financial stability. The rise in insurance rates in California can be traced back to the unprecedented severity of wildfires, worsened by the effects of climate change. Some homeowners have lost their insurance, as companies refuse to cover properties in vulnerable areas.

State Farm has announced that it will not be selling any new home insurance policies in California. pic.twitter.com/6FNyWYmJpW

— TODAY (@TODAYshow) May 27, 2023

The California Department of Insurance recognizes the underlying factors contributing to the insurance industry’s disruption, with climate change being the most significant. Efforts like the Safer From Wildfires initiative and legislation are underway to regulate development in high-risk areas. However, according to Tom Corringham, a research economist at the Scripps Institution of Oceanography, it is unsustainable to allow people to live in homes that are becoming uninsurable or prohibitively expensive to insure. Policymakers must consider proactive measures, such as purchasing high-risk properties or relocating residents from vulnerable communities.

The growing trend of insurance companies reducing coverage or pulling out of high-risk areas underscores the urgent need for comprehensive climate action. Mitigating the financial impact of climate change requires addressing its root causes and implementing resilient strategies. While State Farm’s decision in California may be seen as a necessary business move, it serves as a wake-up call for society to prioritize climate resilience and consider the long-term implications of inhabiting areas increasingly susceptible to climate shocks.

Uganda Passes an Extreme Law Against LGBTQ+

-

An appeals court in Texas has delivered a significant victory to attorney Sidney Powell, upholding a state court judge’s...

-

President Joe Biden’s reelection strategy takes a surprising turn as the Rust Belt, not the Sun Belt, emerges as...

-

In a significant legal development, U.S. District Judge Aileen Cannon has declined former President Donald Trump’s request to dismiss...

-

Major Collision Causing the Collapse of the Bridge The recent collapse of the Francis Scott Key Bridge in Baltimore,...

-

Donald Trump is on the brink of a crucial deadline in a business fraud case, with just a few...

-

Sylvia Gonzalez, a newly elected city council member in a small Texas community, was embroiled in controversy when she...

-

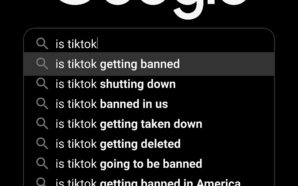

Is TikTok Getting Banned in the States? The United States House of Representatives has voted with bipartisan support to...

-

The 2024 Election Race Continues Between Joe Biden and Donald Trump With the 2024 general election drawing closer, President...

-

Another Successful Moon Landing Intuitive Machines, a commercial space company, has achieved a remarkable feat by landing its Odysseus...

-

Has the State of USA Improved Since Trump’s Presidency or Gotten Worse? Given the current climate of the United...

-

In a surprise speech delivered from the White House, President Joe Biden addressed the recent special counsel’s report and...

-

Is Texas Taking the Right Step Towards a Better America? The Austin Guaranteed Income Pilot, Texas’s pioneering tax-payer-funded basic...