Credit: Unsplash

Billionaire investor Ray Dalio expressed serious concerns about the future of America after the upcoming election, citing the escalating political divide and unsustainable national debt as key challenges the nation faces. Speaking at the Future Investment Initiative conference in Saudi Arabia on Wednesday, Dalio, founder of Bridgewater Associates, called for meaningful reforms to unify the country.

“Both of the candidates worry me,” Dalio told CNBC, referencing Republican presidential candidate Donald Trump and Democratic candidate Kamala Harris. “This left, right and fighting each other is a problem as it becomes more of the extremes. I think there needs to be a bringing of Americans together, that middle of that, and making great reforms.”

Dalio pointed to economic and social divides that continue to widen across the country. While noting Trump’s more capitalist approach could benefit domestic capital markets, he warned that significant deficits will persist regardless of which candidate prevails. “The debt is concerning, the internal conflict is concerning, the external conflict is concerning,” Dalio said. He emphasized the importance of unity and reform: “It’s a shame because we need to bring the country together in a smart way.”

Dalio also spoke about the economic risks of increasing U.S. Treasury debt, much of which is held by foreign entities. This heavy reliance, he says, could lead to market volatility: “Treasury market is basis of all capital formation. At some point, when you combine it with the internal conflict issue…if you have a downturn, I’m worried about internal political and social conflict.”

When asked about investment strategies, Dalio recommended a balanced and diversified portfolio with assets such as gold, which he said can help reduce risk in turbulent economic times.

12 Signs You Are Burned Out and Need a Break ASAP!

-

Sylvia Gonzalez, a newly elected city council member in a small Texas community, was embroiled in controversy when she...

-

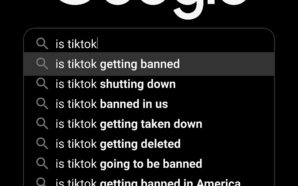

Is TikTok Getting Banned in the States? The United States House of Representatives has voted with bipartisan support to...

-

The 2024 Election Race Continues Between Joe Biden and Donald Trump With the 2024 general election drawing closer, President...

-

Another Successful Moon Landing Intuitive Machines, a commercial space company, has achieved a remarkable feat by landing its Odysseus...

-

Has the State of USA Improved Since Trump’s Presidency or Gotten Worse? Given the current climate of the United...

-

In a surprise speech delivered from the White House, President Joe Biden addressed the recent special counsel’s report and...

-

Is Texas Taking the Right Step Towards a Better America? The Austin Guaranteed Income Pilot, Texas’s pioneering tax-payer-funded basic...

-

Newly Released Footage Reveals Arrest at Miami Airport Newly released body camera footage reveals the arrest of 73-year-old Donna...

-

President Biden’s re-election strategy balances White House proximity with campaign focus in a unique approach to the upcoming election....

-

Jackson Pierce Arrested for Second-Degree Murder and Tampering with Evidence in St. Peters Homicide Case The St. Peters Police...

-

The Trump campaign is optimistic about winning the Iowa caucuses, anticipating a significant margin as a litmus test. A...

-

President Biden takes action in response to attack on U.S. service members Early Christmas morning, three U.S. service members...