Trump and Wall Street’s Top Banker Bury the Hatchet—And Your Wallet Might Thank Them

In an unexpected turn that could bring more calm to the financial markets and a potential boost to your bottom line, former President Donald Trump is reportedly back on speaking terms with JPMorgan Chase CEO Jamie Dimon — marking the end of a long, rocky relationship between the two influential figures.

After years of public jabs and policy clashes, the two recently held not one but two private meetings in the past couple of months, according to The Wall Street Journal. The latest sit-down took place just last week at the White House, where Dimon joined Trump, Treasury Secretary Scott Bessent, and Commerce Secretary Howard Lutnick for a wide-ranging discussion on the economy, trade, and the future of U.S. financial policy.

One hot topic? Interest rates — and that’s where it gets personal for your money.

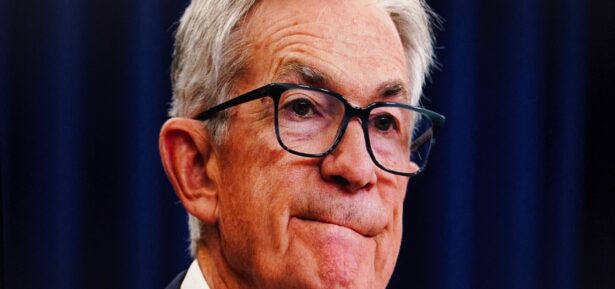

While Trump has long pushed for dramatic rate cuts, even threatening to replace Federal Reserve Chair Jerome Powell over it, Dimon has been a vocal supporter of the Fed’s independence. His recent conversations with Trump reportedly offered a more measured take, suggesting that rate cuts could still be appropriate — if the economy remains strong.

That message appears to be gaining traction. The Federal Reserve just held interest rates steady again this week, after stronger-than-expected economic numbers gave markets a reason to breathe easier. Meanwhile, Trump used the moment to renew his call for lower rates, posting, “MUST NOW LOWER THE RATE. No Inflation! Let people buy, and refinance, their homes!” on Truth Social.

But with Dimon now engaging directly with Trump behind closed doors, some on Wall Street hope his influence could help steer the former president away from more extreme actions — like removing Powell — that could rattle markets and jeopardize Americans’ 401(k)s, mortgage rates, and housing values.

The meeting also touched on more tangible issues for everyday Americans, including the nationwide shortage of affordable housing and how post-crisis regulations might be limiting homeownership opportunities. That’s a rare moment of policy overlap for Trump and Dimon, who haven’t exactly been on friendly terms in recent years.

Their relationship hit a low point in 2017 when Dimon stepped down from a presidential advisory council over Trump’s controversial remarks following the Charlottesville rally. In the years since, Dimon has publicly criticized Trump’s election fraud claims and trade wars, while Trump has fired back by labeling Dimon “highly overrated” and accusing JPMorgan of discriminating against conservatives.

But now? Cooler heads may be prevailing — and that’s news investors, homeowners, and hopeful buyers might welcome.

Whether this new détente lasts is anyone’s guess, but with economic uncertainty still looming and a presidential campaign heating up, the Trump-Dimon thaw could signal a more balanced approach to economic policymaking — or at least, fewer headlines that shake the markets.

-

Fitch Ratings, a leading global credit rating agency, has released a new economic outlook report predicting that the U.S....

-

With Federal Reserve Chair Jerome Powell signaling that interest rates might be cut soon, investors are contemplating how this...

-

Consumer prices in the United States increased at the slowest rate in over three years last month, raising hopes...

-

In a significant shake-up at Starbucks, Laxman Narasimhan has stepped down from his role as CEO and board member...

-

JPMorgan Chase is set to release its second-quarter earnings report before the opening bell on Friday, July 14. Investors...

-

The Federal Reserve announced today that all 31 banks participating in its annual stress test have demonstrated their ability...

-

Wednesday is poised to be a pivotal day for economic news, as investors and economists brace for a crucial...

-

AMC Entertainment Holdings Inc. successfully raised approximately $250 million through a stock sale completed on Monday, coinciding with the...

-

Bank of America has reported impressive first-quarter earnings, surpassing analysts’ estimates for both profit and revenue, driven by better-than-expected...

-

Ken Griffin, the founder and CEO of Citadel, emphasized the importance of prudence in the Federal Reserve’s strategy regarding...

-

Michael Saylor, a prominent figure in the world of cryptocurrency, has seen significant gains this week as the value...

-

The Office for National Statistics (ONS) released official figures on Wednesday, revealing that the United Kingdom posted a record...