Credit: Unsplash

Consumer prices in the United States increased at the slowest rate in over three years last month, raising hopes for a potential interest rate cut by the Federal Reserve. According to the Labor Department, overall prices rose by 2.9% over the 12 months leading to July, the smallest annual increase since March 2021, down from 3% in June.

This latest monthly inflation report comes amid heightened market scrutiny, following weaker-than-expected job growth in July that had stirred fears of a recession and triggered stock market volatility. Analysts suggest that the latest inflation figures could bolster the case for the Federal Reserve to start reducing interest rates.

The Federal Reserve has maintained its key lending rate at 5.3% since July 2023, a level not seen in nearly two decades. This high borrowing cost has translated into increased rates for mortgages, credit cards, and other loans. The Fed’s strategy aims to temper demand and ease price pressures on homes, cars, and various goods.

However, with inflation nearing the Fed’s 2% target rate, driven by lower oil prices and the resolution of pandemic-related supply chain issues, the central bank faces growing pressure to cut rates. Julian Howard, chief multi-asset investment strategist at GAM Investments, indicated that a rate cut in September now seems “all but certain.” Despite this, he anticipates the Fed will proceed with caution, maintaining a data-dependent approach rather than committing to a fixed path.

In contrast to the slowing inflation, recent economic data have shown mixed results. While prices for appliances, cars, and other items such as airline tickets and furniture have decreased, essential household costs like groceries and housing have continued to rise. Over the past year, rent increases have significantly contributed to inflation, with housing accounting for over 70% of the inflationary pressures. Grocery prices also rose by 1.1%, and car insurance saw a notable increase of over 18%.

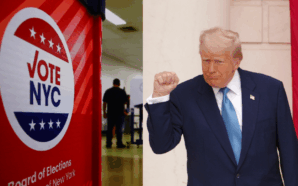

President Joe Biden welcomed the report as evidence of “progress fighting inflation and lowering costs for American households.” Meanwhile, the Trump campaign criticized the 20% rise in prices since 2021, coining the term “Kamalanonics” to highlight perceived economic issues under the current administration.

On Wall Street, investor opinions remain divided on the magnitude of potential Fed rate cuts. Wells Fargo analysts anticipate a more aggressive approach, suggesting that despite the recent rise in rents, the Fed will likely move swiftly to address inflation. They note that core inflation has moderated, with a notable cooling in services inflation, particularly in housing.

The next steps for the Federal Reserve will be closely watched, with the September meeting expected to be a critical moment for shaping future economic policy.

-

Credit: Shutterstock A surprise economic plot twist may be brewing as America heads into the new year: millions of...

-

Credit: Shutterstock A shocking new 115-page report has peeled back the curtain on life inside the FBI under Director...

-

Credit: Shutterstock In a year when many Americans are clipping coupons, stretching paychecks, and comparison-shopping more than ever, one...

-

Credit: Shutterstock Bay Area residents who recently glanced up over the Golden Gate Bridge were treated to an unexpected...

-

Credit: Shutterstock The conversation around potential $2,000 “tariff dividend” checks reached a new peak this week after President Donald...

-

Credit: Shutterstock As President Donald Trump abruptly turned against Rep. Marjorie Taylor Greene, one of his most vocal supporters,...

-

Credit: Shutterstock When President Donald Trump unexpectedly announced plans for what he called a “$2,000 dividend” for the majority...

-

Credit: Shutterstock In a dramatic twist that’s sent shockwaves through both sides of the Atlantic, U.S. President Donald Trump...

-

Credit: Shutterstock The countdown is on for one of the most closely watched shareholder votes in corporate history. As...

-

Credit: Shutterstock President Donald J. Trump sparked fresh political fireworks during a wide-ranging interview on CBS’ 60 Minutes, revealing...

-

Credit: Shutterstock Imagine not having to hunt for groceries after a long day or remember when your phone bill...

-

Credit: Shutterstock While government offices sit quiet amid the ongoing federal shutdown, the White House grounds are anything but...