Pandemic-era policies have reduced rates of poverty and lack of insurance.

According to the latest report from the United States Census Bureau, various policies implemented at the height of the COVID-19 pandemic have had a positive knock-on effect for those on the lower rungs of the economic ladder. Specifically, instances of poverty, especially child poverty, as well as uninsured individuals, are down notably.

Childhood poverty in the U.S. fell by almost half last year, according to Census Bureau data. The drop coincided with the expansion of the federal government’s child tax credit and the distribution of pandemic stimulus payments. https://t.co/fMQkHLTGY3

— The Associated Press (@AP) September 13, 2022

According to the report, child poverty dropped from 9.7% in 2020 down to 5.2% in 2021, while the overall poverty rate fell to 8% from 9.2%. Analysts have attributed much of this positive movement to the child tax credit that was instated as part of 2021’s American Rescue Plan, which provided millions of lower-income American families with tax breaks to afford familial essentials.

“They spend it on their housing, food, education, they’re able to do some of those extracurricular activities that high income families take for granted,” Center on Budget and Policy Priorities researcher Sharon Parrott told NPR. “They are investing in their kids and their families are able to make ends meet in really important ways.”

Poverty in the U.S. fell to the lowest level on record in 2021, driven by a second year of emergency pandemic aid from the federal government, the Census Bureau reported on Tuesday. The number of poor children in the country fell by nearly half. https://t.co/ZvyTcse1GX

— The New York Times (@nytimes) September 13, 2022

However, experts have cautioned that, if the pandemic policies are ended whenever COVID-19 is no longer considered a medical emergency, these improvements could be quickly reversed.

“As soon as the public health emergency is declared over – which could be as early as January – that safety net that was in that COVID relief bill goes away,” said Sabrina Corlette of the Georgetown University Center on Health Insurance Reforms. “And so we could see this historic increase in the rates of the insured be reversed.”

Antonio Banderas Reflects on 2017 Heart Attack

-

Credit: Shutterstock Trump Called to Rescind Jan. 6 Pardons Pressure is building on President Donald Trump to take back...

-

Credit: Shutterstock Trade deficits, national debt, and the numbers that don’t add up President Donald Trump recently caused a...

-

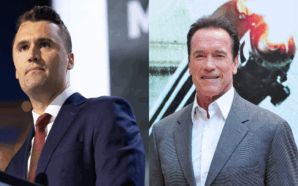

Credit: Shutterstock What Followed After Charlie Kirk’s Death Attorney General Pam Bondi cleared things up today after getting some...

-

Arnold’s Tribute to Charlie Kirk The nation is still reeling from the shocking assassination of Charlie Kirk, the 31-year-old...

-

Credit: Shutterstock Why the Federal Reserve’s Rate Cut Plan Is Stirring Up Trouble The Federal Reserve is about to...

-

Credit: Shutterstock Craziest Week in the USA By Far Hey, America, if you thought things were tense before, buckle...

-

Credit: Shutterstock How a $345 Billion Gap Raises Alarms for U.S. Finances The U.S. Treasury Department reported a federal...

-

Credit: Shutterstock Charlie Kirk Shot at Utah Valley University Event On September 10, 2025, Charlie Kirk, the founder of...

-

Credit: Shutterstock Is Israel Really Our Ally? Israel’s airstrikes on Doha, Qatar, on September 9, 2025, didn’t just eliminate...

-

Credit: Shutterstock Another Failed Attempt by Trump? President Donald Trump sent out a fundraising email in early September 2025...

-

Credit: Shutterstock Chicago’s immigrant neighborhoods are on edge this week after federal immigration agents launched what the Trump administration...

-

Credit: Shutterstock A Blow to National Security or a Win for Civil Liberties? In a polarizing 2-1 decision on...