Credit: Unsplash

Federal student loan borrowers are in a tough situation as the pause on loan payments, implemented during the pandemic, is ending. This means that the average American’s debt limit is going up. A temporary agreement between Republican lawmakers and President Joe Biden has ended the pause on federal student loan payments.

The agreement’s written details state that the pause, which has been active for over three years and covered two different presidential administrations, will no longer be in effect. Borrowers will need to start paying their student loan bills again 60 days after June 30, likely in September.

This pause on federal student loan payments was one of the few relief measures related to the Covid pandemic that was still active. Former President Donald Trump initially announced it in March 2020, and it has been extended eight times since then. The policy has helped borrowers by stopping the accumulation of interest on their federal student debt and allowing them to skip payments without facing penalties. Many Americans have taken advantage of this pause, saving an average of $5,000 in interest during the public health crisis.

According to the current version of the debt ceiling agreement, the pause will end 60 days after the end of June. The U.S. Department of Education will have limited ability to extend this relief further without Congress taking action.

The Biden administration had already been preparing borrowers for the resumption of payments within a few months, with expectations of payments starting again by the end of August. However, new data suggests that borrowers whose loans were frozen are now in a worse financial situation and may accumulate even more student loan debt.

Reports indicate that the pause cost is estimated to be as high as $5 billion per month, and it is expected to reach nearly $200 billion when payments resume in September. By the end of 2021, borrowers who had their loan payments paused increased their credit card, mortgage, and car loan debt by an average of $1,800. They also took on an additional $1,500 in student loan debt compared to those without paused payments.

As the pause on federal student loan payments ends, borrowers face the challenge of managing their increased debt and getting ready to start making payments again.

Biden’s 2024 Re-Election Campaign

-

Employer.com is making headlines once again, this time with an offer to acquire Level, a fintech startup that recently...

-

The devastating wildfires tearing through California have left an indelible mark on the state, and even Hollywood’s glittering elite...

-

Chaos erupts in Las Vegas as Cybertruck explosion sparks tragedy Las Vegas woke up to tragedy on Wednesday morning...

-

A deadly spree on Bourbon Street leaves a city in mourning A night of celebration in New Orleans’ famous...

-

Discover the ambitious goals and forecasts Trump has set for the year 2025 With the countdown to his return...

-

A Critical Breach with Serious Implications for National Security The U.S. Treasury recently confirmed a significant cyberattack attributed to...

-

How leadership changes and shifting power dynamics are reshaping the global stage The Bilderberg Group, one of the world’s...

-

Elon Musk’s holiday surprise leaves fans questioning the truth. Elon Musk, the billionaire entrepreneur and Tesla CEO, surprised his...

-

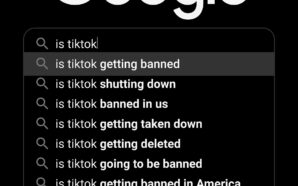

So…Is TikTok Getting Banned or Not? President-elect Donald Trump suggested over the weekend that TikTok might stick around a...

-

How Juicyway Revolutionized Payments with the Power of Word of Mouth? In the buzzing world of fintech, where apps...

-

Credit: Envato Elements The Rich History of The States The United States is full of incredible landmarks that bring...

-

Wit meets politics as AOC fires back at Trump with a clever comeback. Rep. Alexandria Ocasio-Cortez (AOC) is showing...