The end of quantitative tightening may not be the market boost it appears to be

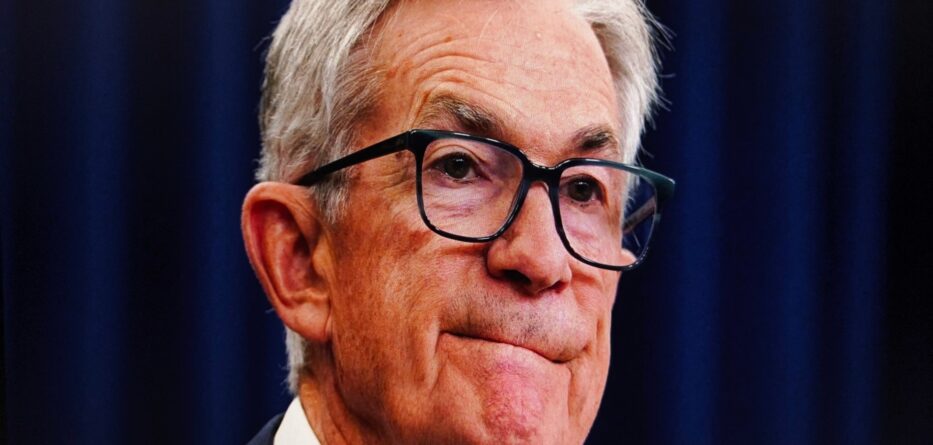

Federal Reserve Chair Jerome Powell just announced that the Fed will soon end its balance sheet reduction program, better known as quantitative tightening (QT). The move signals a major policy shift after more than three years of draining liquidity from the financial system. But while investors may cheer the end of QT, history offers a sobering reminder: this kind of “good news” often comes just before the storm.

Since June 2022, the Fed has reduced its balance sheet by $2.2 trillion in an effort to curb inflation and cool the economy. Conventional wisdom suggests that halting QT should benefit equities since more liquidity could flow into risk assets. Yet the data tells a different story. Over the past two decades, the stock market has actually performed better during periods of QT than during times of quantitative easing (QE).

During this most recent tightening phase, while liquidity was being pulled from the system, the S&P 500’s total return index rose at an annualized rate of 20.9 percent, nearly double its long-term average. Looking further back, since 2003, the index has gained an average of 16.9 percent during 12-month periods when the Fed’s balance sheet was shrinking, compared to 10.3 percent when the Fed was expanding it.

The reason for this counterintuitive pattern lies in timing. The Fed typically turns to QE when the economy is in trouble, injecting liquidity to stabilize markets. But because policy effects take time, these expansions often occur during recessions or downturns, when stocks are already under pressure. The Global Financial Crisis in 2008 and the pandemic lockdown in 2020 both saw massive balance sheet expansions — and equally severe bear markets.

By contrast, the Fed tightens when the economy is strong, as it did over the past few years. QT has coincided with growth and resilience, not weakness. That makes Powell’s announcement potentially worrisome. If the central bank now feels the need to stop tightening, it may be seeing early signs of economic slowdown.

In other words, the end of QT is less a celebration and more a signal. The Fed may be preparing for a softer economy in 2026, one that could test the market’s recent optimism. Stocks might rally briefly on the headlines, but as history shows, these transitions rarely come without turbulence.

Investors should take Powell’s pivot as a cue to stay cautious, not euphoric. If history repeats itself, things could get worse before they get better.

“No Kings” Protests Draw Millions Nationwide

-

Credit: Shutterstock Trump Puts Tylenol on Trial With Pregnancy Autism Warning President Donald Trump announced what he called a...

-

Credit: Shutterstock Judge Rules Against Trump’s Arts Policy, Citing Free Speech A federal judge has just handed down a...

-

Credit: Shutterstock Release the Epstein Files! The backlash is real. FBI Director Kash Patel is under fire as Americans...

-

Credit: Shutterstock Trump Called to Rescind Jan. 6 Pardons Pressure is building on President Donald Trump to take back...

-

Credit: Shutterstock Trade deficits, national debt, and the numbers that don’t add up President Donald Trump recently caused a...

-

Credit: Shutterstock What Followed After Charlie Kirk’s Death Attorney General Pam Bondi cleared things up today after getting some...

-

Arnold’s Tribute to Charlie Kirk The nation is still reeling from the shocking assassination of Charlie Kirk, the 31-year-old...

-

Credit: Shutterstock Why the Federal Reserve’s Rate Cut Plan Is Stirring Up Trouble The Federal Reserve is about to...

-

Credit: Shutterstock Craziest Week in the USA By Far Hey, America, if you thought things were tense before, buckle...

-

Credit: Shutterstock How a $345 Billion Gap Raises Alarms for U.S. Finances The U.S. Treasury Department reported a federal...

-

Credit: Shutterstock Charlie Kirk Shot at Utah Valley University Event On September 10, 2025, Charlie Kirk, the founder of...

-

Credit: Shutterstock Is Israel Really Our Ally? Israel’s airstrikes on Doha, Qatar, on September 9, 2025, didn’t just eliminate...